Analysis of the future development prospects of China’s dental medical industry: It is estimated that the domestic dental market will reach 170-180 billion within 5 years (2019-2024)

China’s dental medical market has great potential

In the context of the improvement of the living standards of Chinese residents and the increasing aging of the population, dental medical services have huge market potential. The potential of the domestic dental service market is manifested in four aspects: adolescent dental problems are not paid attention to, the treatment rate is low, the increase in aging drives the implantation and integrated dental business, the consumption upgrade drives the demand for high-end dental care, and the favorable policies promote development.

1.

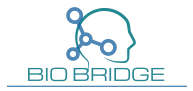

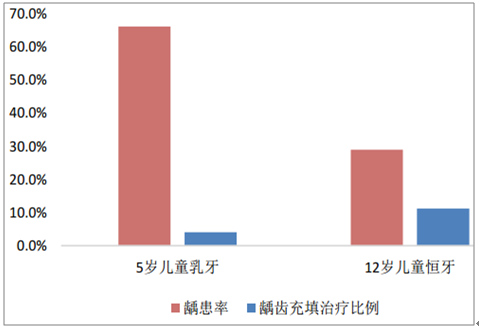

Adolescent oral problems are not paid attention to and the treatment rate is low According to the third national oral health epidemiological survey organized by the Ministry of Health, the prevalence of dental caries among 5-year-old children in China is 66%, and that of 12-year-old children is 28.9%, which is slightly better than the results of international surveys. However, the percentage of dental caries filling treatment for 5-year-old children in China is only 4.1%, and the percentage of filling treatment for 12-year-old children is 11.2%, far below the international average. The main reason is that before children change their teeth, parents think that their deciduous teeth will change, so they generally neglect the treatment of deciduous tooth decay. They do not know that deciduous tooth decay can also cause serious dental diseases. The high incidence of children’s dental problems has brought room for growth in the pediatric oral cavity. At the same time, the comprehensive prevalence rate of malocclusion in China is as high as 67.8%, which mainly occurs in the replacement period and the permanent tooth period, which can be repaired by orthodontic treatment. Doctors generally recommend that the teeth be corrected as soon as possible after the malocclusion is found, so the majority of orthodontic patients are teenagers. Children in the deciduous teeth period also need auxiliary orthodontic treatment when they find dental and jaw deformities.

Deciduous teeth/ replacement teeth/ permanent teeth/comprehensive prevalence

2.

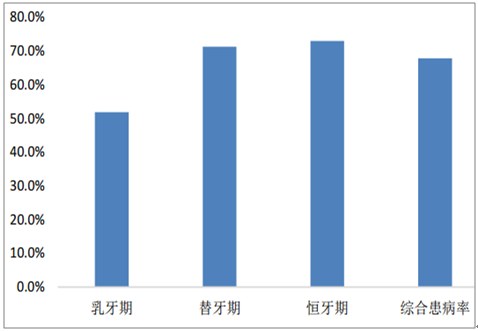

Increasing aging promotes implantation and comprehensive dental business China’s aging problem is getting worse. According to the census information, the proportion of people over 60 years old rose from 11.03% in 2005 to 17.3% in 2017, with an average annual growth rate of 4.74%, and the elderly population reached 200 million. Compared with 12.3% of the global population over 60, China’s aging problem is more serious. At the same time, there is a large demand for elderly health services, including dental services.

0-15, 16-59, 60+

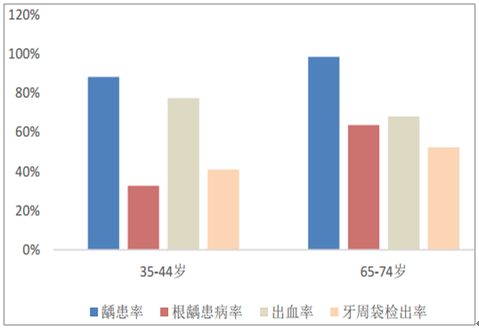

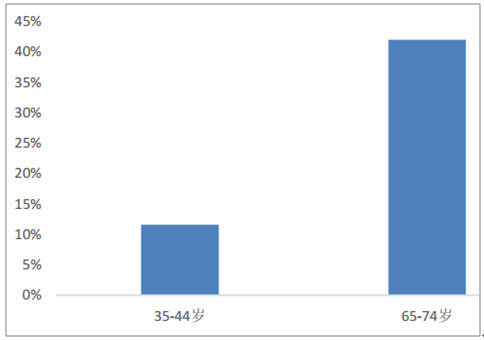

The caries prevalence rate for adults aged 35-44 is 88.1%, and the root caries rate is 32.7%; the caries prevalence rate for 65-74 years old is 98.4%, and the root caries rate is 63.6%. The caries prevalence of the elderly is much higher than that of middle-aged and young people. People, especially the root caries rate. Root caries is a serious gum disease, which can rupture the surface of the root of the tooth, which can easily accumulate dental plaque and food residues, exposing the root and dental nerve to the threat of oral bacteria and dental plaque, leading to periodontitis and a series of Severe gum problems. Root caries mostly occurs in the elderly, and are caused by the shrinkage of the gums caused by physiological degradation, and the roots are exposed outside the gums. Severe root caries requires root canal treatment and installation of dentures. Dental implants are high-end denture services, so most dental implanters are middle-aged and elderly people. Except for dental caries, the prevalence of oral cavity among the elderly is higher than that of middle-aged people, but the repair rate is lower. The restoration rate of dentures aged 35-44 is only 11.6%, and that of dentures aged 65-74 is only 42%, which is lower than that of developed countries. With the improvement of living standards, the aging problem will bring new growth points for the company’s integrated business and planting business.

Blue/caries prevalence, red/root caries prevalence, gray/bleeding rate, pink/periodontal pocket detection rate

35-44 and 65-74 years old

3.

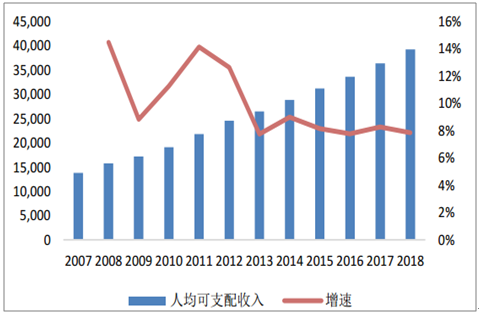

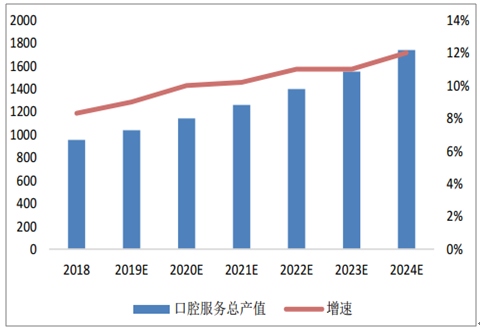

Economic development and consumption upgrading drive the demand for oral care In the dental clinic, comprehensive services and pediatric services, such as dental caries treatment, tooth extraction, periodontitis treatment, etc., can be reimbursed in the medical insurance system. The more expensive dental implants and orthodontic services are not eligible for medical insurance. Therefore, high value-added services such as planting and orthodontics are more similar to consumer products, and their demand will increase with the increase in consumption power. Per capita spending power is a major driving force in the dental industry, which has been growing rapidly in recent years. Since the reform and opening-up, China’s per capita disposable income has continued to increase. Between 2008 and 2018, the average annual increase of urban residents’ per capita disposable income was 10.01%, reaching 39,400 yuan/person/year, with rapid and stable growth. China’s consumption upgrade has also promoted the market for high value-added services including orthodontics and planting. With the gradual advancement of consumption upgrades, it is believed that the dental service market will gradually increase in volume, and the future market prospects are promising. It is estimated that within 5 years (2019-2024), the domestic dental market will reach 170-180 billion. Estimated the total domestic dental market.

Blue/disposable income per capita, red/growth rate

Blue/Total output value of dental services, red/Growth

As a prosperous province in southern China, Jiang has been developing faster than the national average. In 2018, the total GDP of Zhejiang Province reached 5,619.72 billion yuan, ranking fourth in the country. In recent years, the year-on-year growth rate has remained at around 8%. In 2018, Zhejiang’s per capita GDP reached 97,956 yuan, far exceeding the national average. Except for municipalities directly under the Central Government, it is second only to Jiangsu Province, ranking fifth in the country. Zhejiang’s economic prosperity has given Zhejiang people a strong consumption capacity. As the first batch of provinces in China to implement consumption upgrades, Zhejiang people’s attention and demand for dental services have increased year by year, especially the high value-added dental implants and jaw orthodontics. Deformity, dental beauty. It is estimated that the growth rate of the dental service market in Zhejiang Province will be slightly greater than the national growth rate. By 2024, the dental service market in the province is expected to reach 12 billion yuan, and the market scale is promising.

(Source: compilation of public information)